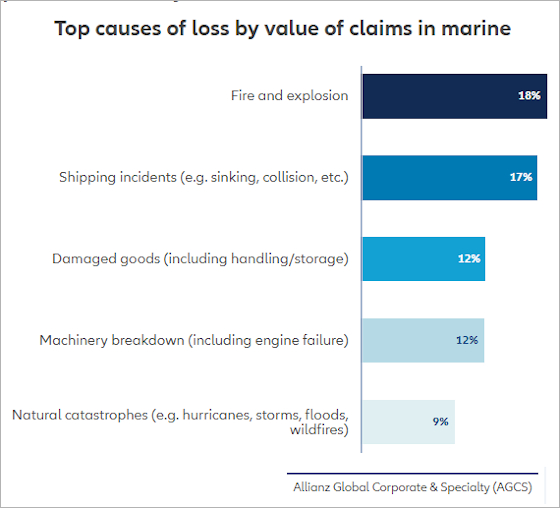

At present, at a time of increased risk exposure and inflation, damage to the load, despite fires and explosions result in the most expensive claims in the maritime sector, are the most frequent cause of losses for the insurance companies in the sector. The marine insurer Allianz Global Corporate & Specialty (AGCS) said on the basis of the analysis of more than 240,000 claims in the maritime insurance industry worldwide between January 2017 and December 2021, for a value of around 9.2 billion euros, analysis that has identified a number of claims and risk trends that are causing the most significant losses for the sector. The typology of accidents adds to the effect of inflation, which is another source of concern for marine insurers and their policyholders as recent increases in ship and cargo values mean that losses and reparations are becoming more expensive, resulting in a greater economic severity of claims. In this regard, the analysis specifies that the increase in the prices of steel and spare parts and the increase in the cost of labour are having an impact on the demands for repairs of the hulls and faults to the machinery of ships.

" The number of fires on board large vessels-explained Régis Broudin, Marine Claims at AGCS, presenting the analysis-has increased markedly in recent years, with a series of accidents involving the cargo, which can easily lead to the total loss of a ship or to environmental damage. At the same time, the maritime sector also faces many other challenges, including a growing number of disruptive scenarios : supply chain problems, inflation, crew members and employees under pressure, increase in losses and damage caused by extreme weather events, implementation of new technologies and low carbon fuels, as well as the Russian invasion of Ukraine. "